Investing in stocks for beginners can feel overwhelming. Are you a beginner investor looking to invest in the stock market? Perhaps you don’t know where to start, or how to get started investing in stocks?

Investing in stocks is perhaps one of the most tried-and-true investment strategies to become wealthy. However, it’s also one of the most confusing. Investing in stocks is a complex subject that means different things to different people.

How to invest in stocks depends on many factors such as, where you stand financially, what kind of investor you are, and what you want to gain from investing in general.

For example, an investment that makes sense to me, might not make sense to you, because you may not be at the level to invest in things that I invest in yet. However, that doesn’t mean you can’t start investing in stocks.

In a moment, I’m going to explain exactly how you can get started investing in the stock market and use this investment strategy to secure your financial future.

How Do The Wealthy Invest Their Money For High Returns?

When it comes to investing, don’t try to get fancy. If anything, you actually want to keep things very simple and invest in what you understand.

Over the years, I’ve learned that being wealthy doesn’t have to be complicated. I personally run my company and my entire organization by keeping things very simple.

As a general rule, when you want to invest in something, the idea is the same. You should choose an investment that’s simple and proven to work.

This is actually how wealthy investors invest their money.

Investing like the rich should be a very dull, plain and boring process. Why?

Because they’re not chasing after the latest investment trends on social media. Or the latest investment schemes and gimmicks, like cryptocurrency, day-trading, “options” trading, forex trading, or any other speculation investing strategy.

No. Most wealthy people I know invest in only a small handful of things that are proven long-term investment vehicles.

Stocks are one of those vehicles.

Real estate and businesses are also among those vehicles.

Real estate happens to be one of the most reliable, high-return investment vehicles that wealthy people like to leverage as it can generate a lot of cash flow.

Now, maybe you are not in a position where you can invest in real estate. And that’s okay.

But investing in stocks, on the other hand, might prove to be a better option in the long run as you increase your income.

How Much Can You Make Investing in Stocks?

Let’s say for example if you could go back in time and invest $1,000 in Berkshire Hathaway stocks, Warren Buffets company. At the time, it was trading at $19/share. If you fast-forward to today, the Class A shares are about $300,000/share.

Do you know how much that investment would be worth?

It would be worth over $16,000,000. For most people, earning $16 million would be virtually impossible.

But if you put aside $1,000 into a stock where you can just let it sit and don’t have to think about it or look at it anymore, one day you’ll wake up with $16 million in your portfolio. Imagine the impact it would have on your life.

But that’s not the most amazing part. Let’s say you had invested $1,000 since 1964, when Warren Buffet first took over the company, and you did that every single year until today.

Do you know how much it would be worth?

Your portfolio would be worth roughly $124,000,000. Think about that for a moment. Let the number sink in.

As you can see, investing in stocks has a lot of potential. But only if you know how to play the game right, which means you shouldn’t blindly jump on some investment bandwagon because you heard it has “potential”.

Most wealthy investors know that investing should not be left to chance. It’s a game you should play with a strategy in place.

Why Most People Think Investing is Risky, And Why it Actually is Not

Most people think that investing is a risky business. If they are speculators or day traders, then, YES, they’re right. Investing is risky.

According to billionaire Robert Kiyosaki, “Many people who think they are investors are not really investors.”

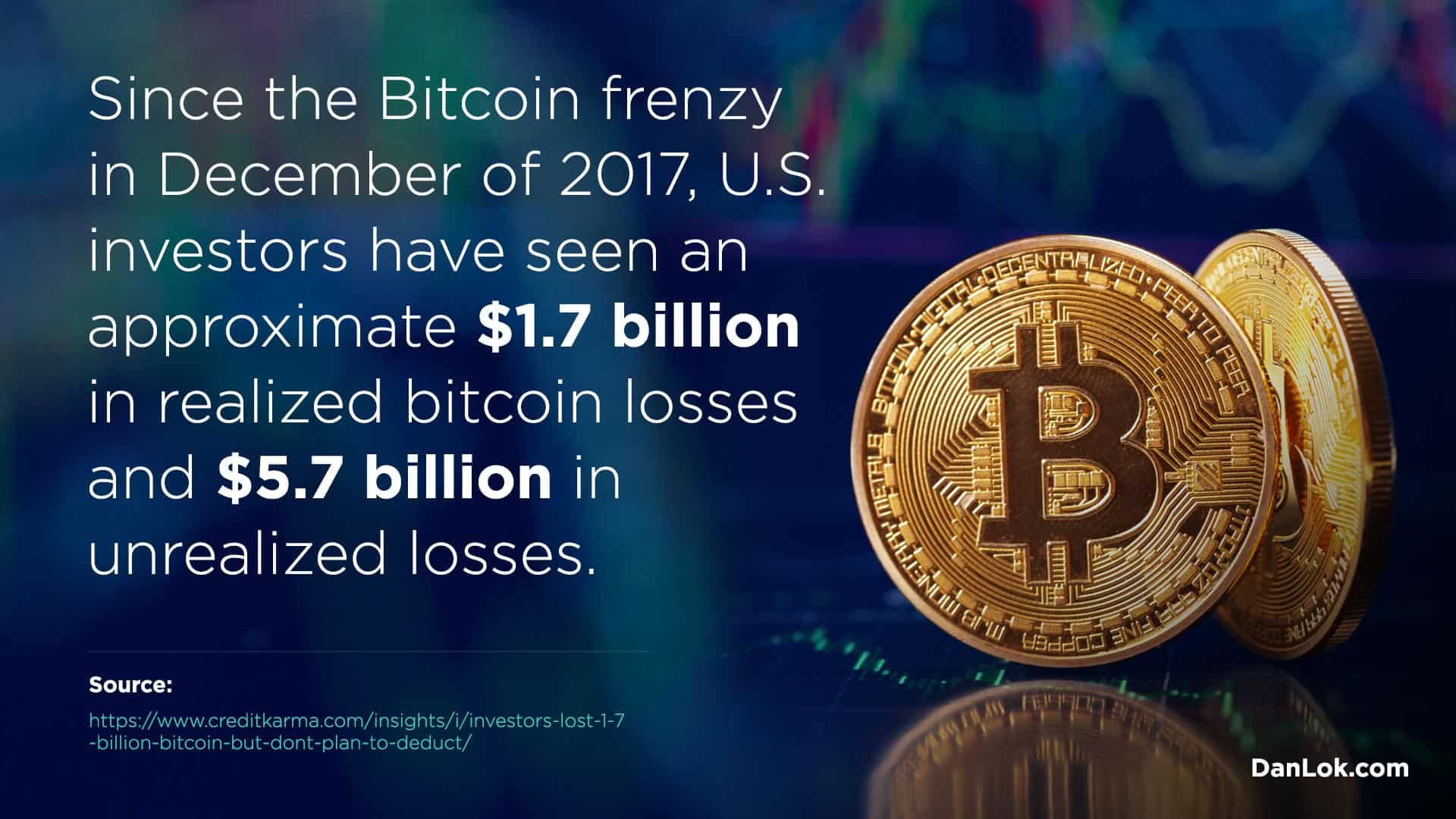

They’ve been taught by society that investing involves chasing after all the drama and chaos. Like putting their life-savings into an imaginary digital currency like Bitcoin, for example.

Since the Bitcoin frenzy in December of 2017, U.S. investors have seen an approximate $1.7 billion in realized bitcoin losses and $5.7 billion in unrealized losses based on a Credit Karma survey.

They’re addicted to the adrenaline rush of speculation in the marketplace. And they base their speculations on hope and luck.

If anything, speculating without any real game-plan or understanding of how an investment works, is actually riskier. They’re essentially gambling.

Those who approach stock investing this way are looking for a shortcut to make that quick buck. They go in with a certain amount of money they’re willing to lose, put that into a stock that “looks good”, and hope to gain something from it when the price goes up.

It’s risky because they could lose all their money the moment the price of a stock drops too much.

People who are too emotionally attached to a stock, for instance, do not have control over their emotions. They let the highs and lows of the market control them instead.

This is definitely not that the way you want to approach investing because you’re basically leaving everything to chance. You have no plan or strategy to make a logical decision.

When it comes to creating wealth through investments, I want you to understand something very important. Your investment skill is very critical, but what’s more important than that is your discipline.

Don’t fall for the shiny object syndrome and jump on the latest investment trend. You have to learn how to control yourself and be clear on what your investment goals are.

When you have clarity on what you want, you’re much more less likely to fall victim to the shiny object syndrome.

It’s not necessarily investing that is risky, it is the investor who is risky. - Robert Kiyosaki Share on XApart from discipline, people think investing is risky because they don’t have the investment skill or financial literacy, to evaluate an investment before jumping into it.

Robert Kiyosaki said it best when he said, “It’s not necessarily investing that is risky, it is the investor who is risky.”

What Does Financial Literacy Mean?

Financial literacy is the ability to read financial statements. It allows you to diagnose the health of an investment and see if there’s anything wrong with it.

You’ll be able to tell whether the investment is risky or not before ever putting a single penny into it.

Most people can’t read or understand them, which is why they think investing is risky. It’s the reason why wealthy people can minimize their risk and see if their investments will have any earning potential.

So my point is, almost all investments do come with some level of risk. The degree of that risk varies among different types of investments.

However, it is the investor that evaluates how much risk is involved. This is what makes wealthy people safe investors and allows them to make safe investments.

Investing is Not an Act, But Rather a Habit

Many people make the mistake of thinking that investing is an act. They think it’s something that just happens.

No. Investing is a habit.

You’ve probably heard the common saying that human beings are creatures of habits. And it’s true.

Your habits are the reason why you can wake up and brush your teeth every single day without much thought or effort. It makes up a substantial part of all your daily routines.

When you say you want to invest so you can start growing your portfolio, it should be a habit, not something you just randomly do.

It’s like when someone says they want to lose weight. You can’t expect to lose weight if you go to the gym only once a week and at the same time you go back to eating fast-food.

It doesn’t work like that. You have to make a commitment to yourself that you will go to the gym five times a week while eating a healthy diet.

Investing is very much the same way. You need to make it a commitment and a habit that you’ll do for a long time.

I have the same belief about the rich and the poor. You can’t become rich if you don’t have the habits of a rich person. Likewise, a poor person is poor because they have the habits of a poor person.

To me, it is all based on habits because how you do anything is how you do everything.

How you do anything is how you do everything. Share on X

You’ve Already Made $1 Million – And May Not Even Know It

Let me put this into context, let’s say you’re making $35,000 a year. If you take $35,000 and multiply that by 40 years, you’ll have $1,400,000.

You see, you have over a million dollars but the reason why you haven’t realized it is because you don’t have the habits of investing.

And that’s the issue. Instead of looking for the greatest investment, develop the best and the greatest investing habits.

Don’t wait until you have money because if you’re not investing the little bit of money that you have today, guess what.

As you make more money, you’re not going to invest. It’s just not going to happen because you haven’t made it a habit.

If you’re making $1,000 and you’re not investing $1, what makes you think when you’re making $10,000 or $100,000, you’ll start investing?

It will not happen.

Like I said earlier, It’s not about chasing the latest investment trends.

Now you may be thinking, “So Dan, What are you saying? Are you saying that I just need to put a little bit of money aside and put it into some kind of low fee index fund and that’s all I need to do?”

Yes. That IS exactly what I’m saying. That’s it.

People are running around chasing all of these new, fancy investment techniques when all they needed to was put their money away.

Money doesn't come to you when you're desperate. Money comes to you when you feel secure. Share on X

But when you stop to notice and study how investing really works and how wealthy investors invest. You’ll see that it has nothing to do with picking up on the “hottest investment strategies of 2020,” so to speak.

When you have the habits of investing and when you know how money works and combine that with discipline, more money comes to you.

Master The Wealth Triangle For Long-Term, High-Return Investments

When you develop the habits of investing and start putting money aside, you also want to increase your earning ability. Because then as you’re making more, you can set aside more money for it to grow in value.

You see, the key to actually creating wealth is actually very simple. All you need to do is earn more than what you spend. And here are three ways you could do that:

- Develop High-Income Skills

- Develop Multiple High-Income Skills

- Build a Scalable Business

This is actually a large part of a concept that has guided me on my path to wealth and success. It’s called The Wealth Triangle:

And it starts off with developing a High-Income Skill that allows you to generate at least $10,000 a month in income. Second, building a scalable business. This is a business that you can grow and repeat without a lot of infrastructure, like people and systems. And third is high-return investments to build your net-worth.

Now, you’ll notice that as you learn how to increase your income year after year, the whole world of investment opportunities will suddenly open up to you. Giving you a variety of investments you could invest in.

While that means you’ll have more investment options that you were not aware of before, it doesn’t mean that you should dive into them just because they “look” interesting or “look” like they have potential.

Personally, I have hundreds of investment opportunities that come across my desk and I probably reject 99.9% of them.

I am very careful and aware of what I choose to invest in because I know exactly what kind of investor I am. I know what I want to gain and I’m very clear about the end goal.

Remember, before you make any investment, you need to develop your investment skills and maintain your discipline.

So when you are earning more than you’re spending, you want to take the difference (Earnings – Spendings = Remaining $$$) or the spread.

Then take this difference and invest it in solid, reliable investments over a long period of time. That’s it. There’s nothing complicated about it.

When you’re putting money aside, suddenly you’ll have more money. And as you keep improving and upgrading your skills, you can earn more and you can invest even more.

Money doesn’t go to the people who need it the most. Money goes to the people who know how to multiply it. Share on X

Now you can go enjoy life.

That’s the key when you understand how money works. Everything else is simple.

So that’s what I recommend.

You don’t need to learn how to pick that perfect stock. You don’t need to learn how to pick the perfect investment. And you don’t even need to be a sophisticated investor.

If you want to do that, you definitely could. But what I’m saying is that for most people, they simply don’t have the time, the discipline, or the intelligence to learn how to be a sophisticated investor. You don’t need that to win.

All you need to do is follow this simple blueprint:

- Establish your discipline

- Put some money aside consistently

- Invest for the long term

Now you may be thinking, “Okay, Dan, I get it. That’s the 40-year plan. You’re telling me what I need to do over the next 30 to 40 years investing over the long term. But what if I want to become a more sophisticated investor? And I want to be an active investor with a 3-year, 5-year, or 7-year plan. What do you suggest?”

The Best Way to Become a Sophisticated Investor

I will be conducting a small intimate, exclusive workshop called Secrets Of The Rich in Las Vegas for a small group of my students and for my fans – where I will reveal some of the best-kept investment strategies of the rich.

Now I’ve never done this before. This is the first time I’m doing this. Usually, I do events with a very big group of my students.

But this is going to be a very intimate event where I’m going to teach you how to become a professional investor. I’m going to teach you how to build the foundation and learn some of the fundamentals of investing.

So it doesn’t matter what you invest in, you will now have the intelligence for the rest of your life to look at different opportunities with a strategy to win.

You’ll no longer have to risk losing money and chase after the latest investment gimmicks and schemes. You’ll be equipped with the knowledge and skillsets to evaluate any investment opportunity with confidence.

If you want to become a sophisticated investor that earns high returns with minimal risks, click here to access my exclusive live-stream event now.

(Featured Image Credit: Bart Sadowski / Shutterstock.com)