If you’ve been in business for some time, you most likely know about strategic scaling. By way of deals and acquisitions, it allows you to add valuable businesses to your portfolio. This is a very effective business strategy, and one of the best ways to generate wealth.

Most people have a firm perspective on business. They think it’s about dressing up in suits, holding meetings in cushy conference rooms, or shaking hands after months of harsh negotiations. All of this is true. However, most people do not realize that not all business is done this way.

In reality, only a few people in the business world know what it’s really like. Most have never found themselves analyzed from head to toe by another business person, or at a meeting aimed at exploiting their weaknesses. The old saying “business is war” is very true in these scenarios. If you’re looking to use strategic scaling to acquire businesses, you better get used to it.

Not all business deals are smooth. Many business people understand that sometimes they have to be mean. If you’re looking to get the best deal possible, there are many factors that come into play. These include intimidation, leverage, debating, and psychological warfare – all of which are not for the faint of heart. If you’re looking to build an empire, you’ll need to know how to use every tool at your disposal.

Here’s an in-depth look at strategic scaling, and what occurs behind the scenes during high stakes acquisitions.

Creating A Business vs. Buying A Business

Most young entrepreneurs dream of starting their own business and imagine themselves as a one-man team. Over time, that one man team grows into a 10-men organization and, eventually, into a worldwide corporation.

Many people believe starting a business is the key to becoming rich. But not many people realize there is another way to create wealth: one without the negatives that come with starting a business. These negatives include factors such as a high failure rate, low starting capital, and time constraints.

Many experienced business people prefer to buy pre-established businesses. In fact, this is the primary goal behind DanLokAcquisitions.com. It’s one of the many organizations in the Dan Lok brand that focuses solely on acquiring existing businesses.

Acquisitions is one principle behind strategic scaling. It shelters you from the risks of building a business from scratch. By buying businesses already proven to succeed, you can generate wealth much faster.

Let’s say you notice tons of customers every time you pass by your local bubble tea shop. Over the last 3 years, the business has only gotten better.

A passionate entrepreneur would see this and think of opening their own bubble tea shop. They realize there is a high demand for bubble tea and aim to compete with their local bubble tea shop for market share.

A smart entrepreneur, however, would not go through that hassle. They would simply buy over the shop.

The Shortcut To Wealth Few People Know About

Buying a business is much more efficient than starting one. A well-established bubble tea shop already has a customer base and a team of well-trained employees. Their bubble tea drinks have already been proven to be popular with the market, and there is solid evidence of positive cash flow every single month.

This is why acquiring already established businesses is the core foundation of strategic scaling. Buying a business means acquiring a source of cash flow. You are using money to take over an asset that will continually generate more money for you; the more businesses you acquire, the higher the cash flow.

If you had heard the phrase “the rich get richer”, you now understand why. Rich people use their assets to create more wealth. They also understand that time is the most valuable asset, and know it is more efficient to buy a business rather than to spend years building one.

Take, for example, billionaire Richard Branson. He owns over 400 companies and is valued at over $4.84 billion. Despite the massive net worth, he still acquires businesses to this day.

How To Buy Businesses With No Money Down

Here’s a question: what do most people do when they cannot afford something? They make excuses and complain that they “can’t afford it”. They have a poor mindset that prevents them from seeing other ways. Instead of finding those ways, they allow money to hinder their goals and dreams.

You don’t have to be rich in order to generate wealth. In fact, it’s possible to buy a business with no money down. This is possible by using a debt-driven model. Instead of buying a business with cash, you do so through debt.

For example, let’s say you know the CEO of a company. He is 80 years old, has no children, and is interested in selling his business. He wants $300,000 for the business. The business generates $50,000 a year.

One way to acquire this business is to use $300,000 of your own money. Another method is through debt. It is likely you will not have enough cash, and this is where your ability to make deals comes into play. Here’s one way you can do so:

- Talk with the business owner and come to an agreement

- Get the business owner to show you their accounting books – this includes assets, expenses, accounts receivable etc.

- Bring this information to a bank

- The bank will look at the paperwork and tell you how much money they can loan you

- Go back to the business owner and work out a deal

How To Use Your Brain To Make Money

Now let’s assume the bank is willing to loan you $200,000, and you need to come up with another $100,000 to make the deal happen. There are many ways to do this. One way is to use what is called a leveraged buyout.

Speak with the business owner and draw up a contract. The contract states that they will transfer ownership of the business to you. In exchange, you will use the profits from the business to pay them back. This payment can be made over 1, 5 or even 10 years.

If the business owner agrees to these terms, then congratulations. You have acquired a business using no money down. Instead, you leveraged the bank’s money and the profits from the business. You acquired a business that generates $50,000 for $0. Most importantly, you used none of your own money to make this happen.

In this example, you leveraged the assets and cash flow of the business to buy out the business. Other methods of acquiring a business with no money down are notes of interest, percentage of revenue, and using equity from other assets that you own. There are many ways to make deals happen. Use your creativity to come up with solutions that work for you.

A Poor Mindset vs. A Rich Mindset

Having a poor mindset is dangerous. People with a poor mindset would read this article, say “$300,000 for a business?! I can’t afford that!” and leave it there. They would not think of other possible ways to seal the deal.

Rich people understand that it is not about having money, but about being resourceful. Some of the most successful people today started with no money in their pocket, yet they managed to become multi-millionaires and billionaires. This is because they are resourceful. They used their brains to put assets together and make things happen.

Having a lot of money does not make you rich. Having the skills to create a lot of money is what makes you rich. This is because you can lose your wealth, but not your skills. As long as you know how to make more money, you will never be poor.

Therefore, if you want to use strategic scaling in your business, you need to know how to put together deals. You need to train your resourcefulness skill to create opportunities.

The Art of Closing, Negotiation And Deal Making

What is the most important trait when it comes to strategic scaling? It’s not who you know, and it’s not how much money you have. Strategic scaling is about how well you can close, negotiate, and create deals.

In theory, strategic scaling using a debt-driven model looks easy. In practice, it is very difficult. This is because human beings are complex creatures. In order to make deals happen, you need to know how to communicate with business owners.

For example, let’s say you are negotiating with a business owner and the price they had set is too high for your liking. What can you do to convince them to lower their price? How can you use leverage to shift the deal in your favor? If you are a High Ticket Closer, you may have some ideas.

You always want the best business deal for yourself. Strategic scaling is about effectively scaling your business and net worth. This involves using influence to ensure business terms are to your advantage. The most efficient way to ensure this is to use leverage.

People with leverage have dominance over people with less leverage. In other words, just as humans gained advantages over animals by creating leveraged tools, similarly, humans who use these tools of leverage have more power over humans… Share on XHow To Use Leverage To Create Favorable Terms of Agreement

Leverage is about taking advantage of opportunities to create favorable conditions for yourself. Here’s an example of how to use leverage.

Let’s say you approach a business owner and ask if they are selling. You spend the next few weeks negotiating and talking about the deal. At the end of the month, both of you are unsatisfied with the terms. The business owner wants $100,000 for their business. However, you aren’t willing to go above $60,000.

How would you use leverage in this example? How could you shift the deal in your favor? The key is to observe the situation from every perspective. Having awareness of your environment is one of the most important factors when it comes to winning a war. This also holds true in business.

One of the biggest reasons business owner’s sell out is because they are tired. They have been running their business for years, and cannot do it for much longer. Unless they sell the business, they are stuck with it.

In most cases, there are not a lot of buyers on the market. Business owners do not publicize their willingness to sell; they don’t run ads or do marketing. This gives you the chance to present yourself as the only serious investor, and assert your terms. Are they willing to say no, and risk losing their one and only potential buyer?

A Strategic Scaling ‘Hack’ To Making Deals Happen Smoothly

One way to use leverage in business is by using time and appealing to logic. But, if you’re looking to use strategic scaling in your business, you’ll want to appeal to emotions.

A business owner choosing to sell their business tells you a few things. Firstly, their children are not interested in taking over, for whatever reason: they may be spoiled, may not have the acumen to run the business, or simply want to pursue another path. Whatever the reason may be, these are all things you can use as leverage.

However, going up to a business owner and being direct is not going to work. If you say “you should sell your business to me because I know your kids are deadbeats who don’t know how to run a company,” you are going to meet heavy resistance. Instead, put yourself in their shoes.

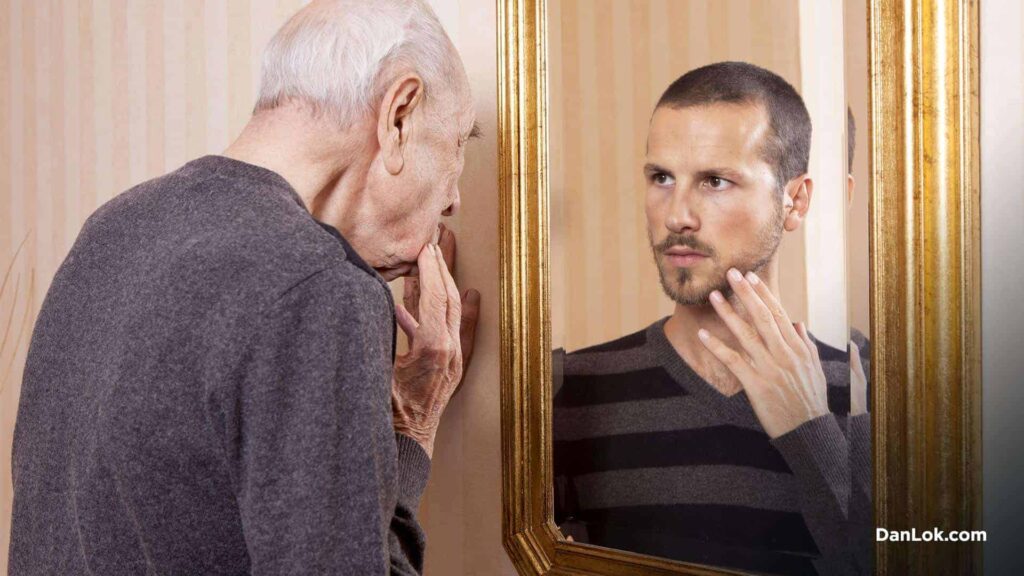

You’re a business owner close to retirement. Your kids don’t want to take over the business that took years, energy, and money to build. You want to pass down your legacy, but your children do not want anything to do with it.

Suddenly a young, passionate entrepreneur comes up to you and says that they are interested in taking over your business. They want to take on your legacy, embrace what you’ve built and improved upon it. How would you feel in that moment? You would most likely be touched.

This is one method to appeal to a business owner’s emotions: show them that you are a younger version of themselves. Show them that you are similar. Appeal to their emotions, and they will be much more open to your advances.

Change how your prospect perceives you, and it will make all the difference. Share on XWhy Smaller Fish Win In The World of Acquisitions

When it comes to strategic scaling, smaller is better. The smaller your team is, the fitter you are for acquisitions. This is because larger corporations have a bad reputation.

A lot of big companies are public companies, which means that shareholders influence their decisions. As a result, big companies only have one goal in mind: to maximize revenue at any cost.

Some corporations buy smaller companies and end up destroying them. They don’t care who built the business, about the employees or about nostalgia. Their only goal is to generate more money. As a result, many businesses they buy over lose their identity.

Employees get laid off and replaced. They cut costs and lower the quality of the products or services. The name of the business gets changed and absorbed by the brand.

The business owner spends decades building their legacy. But in less than a week, everything gets destroyed. One reason why many business owners do not like to sell out to big corporations is because of these reasons. They know what would happen if they did, and they do not like it.

Compare that to a smaller organization that isn’t interested in maximizing revenue. Someone willing to take over what exists and build on it isn’t going to turn a legacy into another cash cow. They’re going to treat it with respect.

If you were a business owner, who are you more likely to sell out to – someone who reminds you of yourself at a young age, or a group of money-hungry executives looking for the next opportunity?

Bigger is not always better; a small fish can swim much faster than a larger one. Share on XAre You On The Path To 7, 8 or 9 Figures?

Strategic scaling is one of the best ways to increase wealth. Acquiring existing businesses allows you to avoid many pitfalls. You don’t need to spend resources growing a business from scratch; you can buy over an already established business. This allows you to leverage existing businesses and create additional sources of cash flow.

Acquiring many businesses is one way to create a successful portfolio. However, most entrepreneurs struggle to get past a certain mark. They know they need to strategically scale their business, but lack the knowledge to do so. They might not know how to close. Or they may be terrible at negotiating. This prevents them from becoming successful.

This is why having a plan is important. A plan allows you to measure your performance and make sure you are on the right track. When you can see your weaknesses, you can overcome them. A business leader with no weaknesses is a force to be reckoned with. If you want a checklist that 8-figure companies use to keep themselves on track, get your copy of the Dragon 100™ checklist here.