Whether you lead your team at work or your own business, you probably wonder – what makes a good leader? No matter what you do, the question is always the same – how can a leader create a high-performance team? As your business grows, you notice you cannot do everything yourself and you need to start having a team of people around you. Many entrepreneurs have a problem with being control freaks. They want to control everything and are afraid to let others make decisions independently. But you must know – delegating effectively can help you reach your goals faster.

If you don't know your team's goal - you're not doing your job as a leader. Share on XSo, how to build a powerful team around you? This is a topic we could spend hours talking about. But let’s start here: leadership, management, and human psychology – the key to success in business is in the right mix of these ingredients.

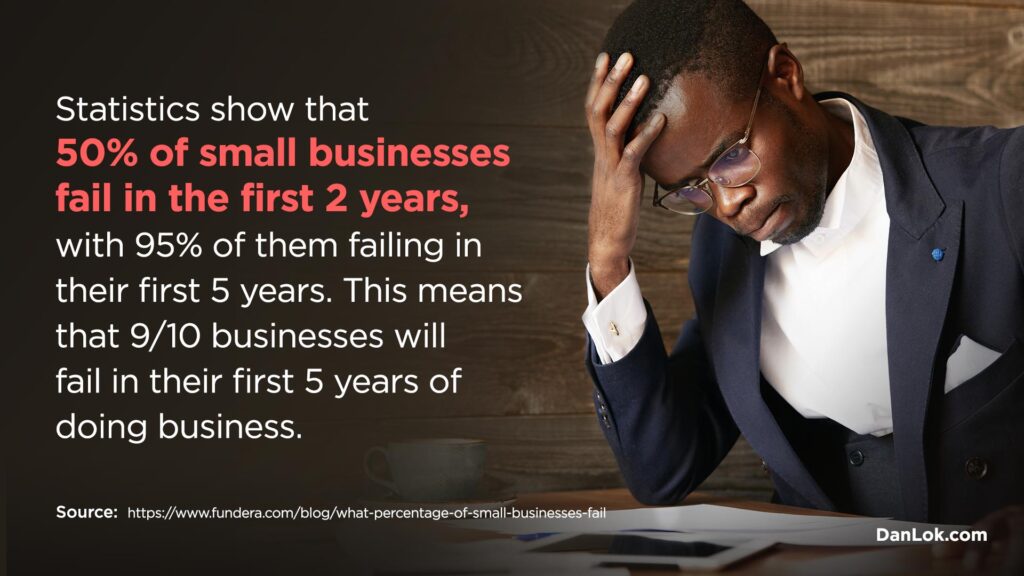

It’s fine to do a lot more work when you just start a business. But, as it grows, if you don’t have a team – your business will remain the same and won’t be able to scale. And if your team doesn’t work well together, you will face incompetent workers and inevitable losses.

With that said, if you’re a business owner and trying to build a successful high-performance team, you must understand your people. First, have a conversation with them. Listen to why they want to be there – by your side. What are their goals? Aspirations? What drives them? Only when you know answers to these kinds of questions and get to know your team will you know how to manage them.

A good leader will take the time and effort to do this. Communication is very important in all aspects of life, especially for leaders and entrepreneurs.

Let Go of Control

Hiring people with the same mindset will benefit everyone because those are the people who work together to reach the same goal – they have the same, shared, mission. With that said, finding the right people for your team is not easy. Usually, people come and go. Most organizations hire people who work set hours and quit if they are dissatisfied or unhappy. Many people work set hours, but do not really give their best to use that time efficiently.

The worse thing is, some business owners only think about how much money they make, and they don’t care about their employees. Sometimes they control everything – from money to sales. They hover over their employees, do not let them get creative, and do not give them the freedom to do their best. This is a part of the control freak mindset we mentioned earlier. The truth is – if you have this control freak mindset – you will only draw attention to low-performance employees. S

o, to start building a strong team, you must let go of the control. That’s the first and most important step.

Get Your Team Involved With Your Vision

To make people passionate about their work, you have to have one thing first – a compelling vision. Your vision is your greatest asset. And when it comes to leadership you cannot inspire anybody without a vision.

Think about history, when someone wants to conquer a country, they must inspire people by sharing a clear vision of the conquest. The vision inspires commitment. You show them – this is what we’re going to do – and – this is what our victory is going to look like.

Now, when you have a vision, you need to constantly share it with your team and remind them of it. Getting them excited about the vision is one way to build their level of competency and efficiency. Because people go through ups and downs… you have to keep reminding them of the vision and “selling” it to them over and over again.

Here’s a video for you about why it is crucial for leaders to have a strong vision

Show Courage

If you’re unsure about your vision, you better not share it. The only thing you want to share with your team at all times is unstoppable and unshakable confidence.

But then again… leaders also develop cold feet. Sometimes things don’t go as planned and you might want to give up. Commitment to a vision takes courage as well as self-discipline. Make decisions and stick with them. Build a vision, and develop a strong mindset. Your mindset is the key to success. It’s what will keep you going even when you’re not entirely convinced or when things don’t work out in your favor.

Inspire Commitment to Your Mission

When you have a vision you’re secure in – constantly remind your team it. If you’re building a business because you want to be rich – that’s a wrong mission and there’s no vision there to get others excited about. Why would they want to help you get rich? You can’t create a high-performance team that way. You need to have a mission that inspires people – beyond just your own self-gain. The reason being, if you focus on your own self-gain, it may inspire only one person – Yourself.

The thing is, people want to belong to something bigger than themselves. They want to belong to some big vision and know that what they do is important to them. They want to know that you can and want to make a difference and they want to know that this difference will matter in the marketplace. So, think about it and write out your “Mission Statement.” If your team is behind this mission – you will have a high-performance team.

Now, let’s talk about the most important part – maintaining your mission.

Establish A Culture-Driven Team

What makes up your culture is your value. Now that you’ve got your vision and mission, the third pillar of your team is the value of your company. What do you stand for? If you answer this question, you will be able to build a strong team culture.

In our team – culture is the key. People don’t separate themselves into different departments. Everyone is very helpful and supportive of each other and we work together toward our common mission. Everyone has a task, but we work towards our goals together.

We argue, learn, fight, and then get back to work the next day and it’s all forgotten. We may have our disagreements and different opinions, and we love that. Disagreement is where we grow and we cultivate different opinions. We lay down our different options and we find solutions together. We’re focused on growth and excellence.

We are committed to our work and we do not believe in 9-5 schedule. People who are looking for 9 to 5 jobs are not a good fit for our organization. They would not fit the high-performance team we are.

Avoid Self-Gain

If you’re a lifestyle entrepreneur, it’s going to be challenging to build a high-performance team. A lot of people will say: I want to work from home and I just want to make enough money by working from home. or I can choose my working hours when I work from home. What kind of a team can you build with this type of “motivation.”

Is this a proper vision? Mission? What kind of culture does this build? This is all about you and your needs, but where are your team-members? What kind of culture are you striving to cultivate?

You need something big to attract talent. A self-centered mentality will not build a strong team.”... Share on X

Big Things Inspire Millions

When Bill Gates said that he is going to put a personal computer in every household in North America, he presented an irresistible vision. With much determination from his high-performance team and himself as a leader, they achieved their vision.

Now, think about Elon Musk – travel through space – that’s a big thing. The kind of thing that will inspire millions…Even though it’ll take them 5 to 10 years or 20 years to make it happen – that’s a big goal to look forward too and work for. Let’s say you’re not thinking that big.

But not everyone is Bill Gates. So how do you start something small, yet inspiring? What should you do as a leader?

SurveyMonkey survey found that 87% consider access to health care to be a critical part of any job and 65% see opportunities for advancement as the key component of any good job. So, what can you offer to your employees? What are the things that are important to them that you can still offer? What is the big thing that they can have if they join your team that would inspire them to commit and devote themselves to your mission?

Be Upfront With Employees

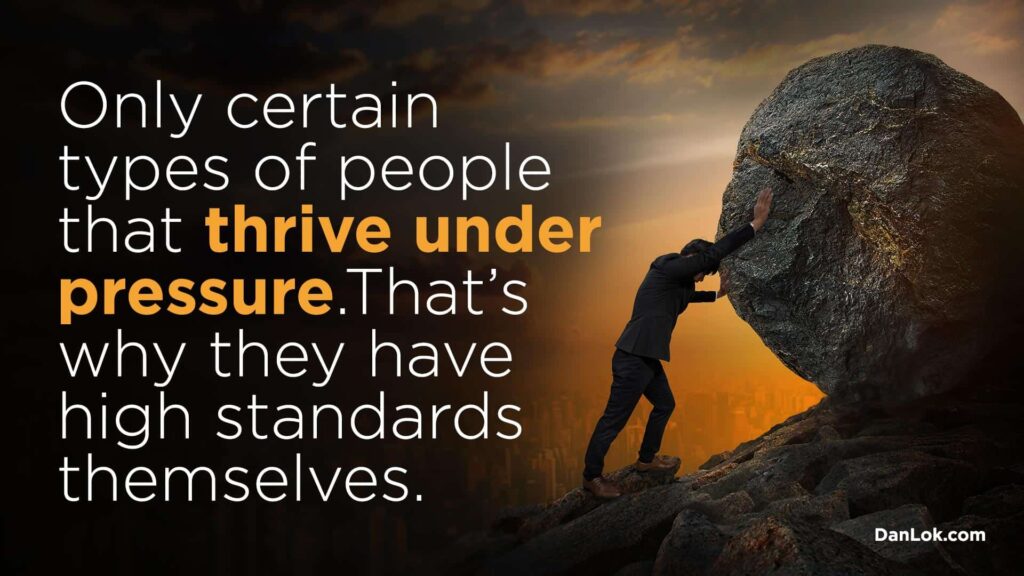

Working for our team is intense. It involves long hours and hard work. We have high standards and we don’t tolerate poor performance. Bad performers just don’t last in our company. We’re very upfront with that and we let them know what they’re getting themselves into right away. If they’re willing to accept that and if that’s what they want too – they thrive to excellency. Their talents expand and strengthen and our team outperforms itself consistently.

With that said, it’s important to mention that only certain types of people thrive under pressure. They have high standards for themselves. These are the kinds of people that our team pays special attention to. We take time to get to know them…to find out what drives them…how they stay motivated and organized. When we know what drives our best performers, we know how to inspire and organize the rest of the team too.

Make Your Team’s Dream Come True

When you know what you can do for your team and you help them make their dreams come true – you get loyalty. When you’re upfront with your team, they’ll trust you more. Ask them about their personal and professional goals and talk to them about how you can make that come true.

Think carefully about what positions are the right fit for whom on your team. If you know their goals and dreams, you must match them well to the positions they hold and the growth opportunities and possibilities of that position. Your mission and theirs must align, but their expectations and your realities must align as well for your team to be satisfied. Dream big, and manage expectations carefully.

You Are Who You Attract – Inspire More Than Being Driven

We always tell our team – there are no limits to how much they get paid. It’s much more about how much value each of us adds. If you want to make $100,000 thousand income – find a way to add value and get there. It’s simple!

High performance people dictate their price. Share on XSo, if you can be a leader who’s inspiring and compelling, you won’t have any problem attracting talent. You will always have talented people who want to work with you. People will help each other and support each other on the way to the achievement of their mission. If the culture is right – disagreements will occur too. Conflict is a part of growth and a good team needs to know how to welcome opposing ideas and support each other in finding the best solution for all.

That’s the culture that we’ve created because of what Dan Lok is. This is something he inspires in the team. He welcomes differing opinions and ideas. We’re growth-oriented and we focus on excellence.

You are who you attract. Look within yourself...if you attract bad people, you need to rethink your core values, your vision, and mission. Share on XSo, look at yourself…What are your standards? What and how do you perform best?

Surround Yourself With Inspiring Mentors

It’s more of a pull than push effect. Leaders with the high-performance team must know how to create energy and enthusiasm. If you do this well and you inspire people to commit, they will think about how to add more value.

As a good high-performance leader, you need to keep your people inspired and remind them that they are on a mission. You must be a great communicator. Someone who understands people, their psychology, and who can get them talking about their struggles as well as their dreams.

When you are a good leader and you manage to inspire others, you will attract amazing talent – talented people want to follow a good leader.

Good leaders, attract amazing talents – talented people will follow you wherever you go. Share on XThe most important part of your success as a leader is your ability to inspire others. If you can create a compelling vision that others want to be a part of, then you will attract talented people ready to commit and do anything to achieve their goals. This is easier if you surround yourself with people who inspire and drive you.

If you don’t have an inspiring advisory board, then you will not be able to sustain your enthusiasm and drive and it will carry over to your team. Find mentors and advisors who can provide you guidance and be a system of support for your growth. Surrounding yourself with the right guides who will inspire you is the key to your ability to inspire others.

These mentors can be people who helped you as you were building your career and your business, or they can be people in your industry that you find inspiring and want to learn from. It is never too late or too early to get good mentors and advisors. Research and reach out to people you want the support from.

Build An Advisory Group

No great leader did everything on their own. We hear often about how they inspired and motivated others to take action. But what we hear less is who helped them and inspired them to move forward.

The truth is, if you are serious about your growth and making your team into a high-performance team, then you need to challenge yourself to constantly improve and reinvent things. You have to be in the loop, informed and driven to always look for the next best thing, for the next best strategy, and the next thing that will make your team more powerful and more driven. People are inspired by innovations and transformations. It’s a part of our nature.

You have to find a group of people to share your business ideas and struggles with and allow them to take you to the next level. Dan Lok always says that one of the main elements for his immense success in business was that he always tried to be the “dumbest person in the room.” He sought out people who are better, whose businesses are at the next level from his, the ones whom he can learn from and grow with.

Now, you might have great friends and family, but to be truly successful you also need to be surrounded by people who are trying to achieve goals similar to your own. You need to seek out people without any other agenda but providing support to you and your business. Experts who know how to help you grow and build a successful team and expand.

If you do not know people like this already, find a group to join. If you are serious about growing and expanding your business until it becomes a global force, click here to learn more about Dragon 100, Dan Lok’s exclusive advisory board for Distinguished Entrepreneurs. In Dragon 100™, members receive the proven systems, templates, and processes that will take them from $100,000 to $1 million … and then from $1 million to $10 million+ and beyond.

Discover How To Get Paid Based On The Value You Bring

Discover How To Get Paid Based On The Value You Bring