Most entrepreneurs think closing is all about what you say during the call, but understanding why your clients say no is just as crucial.

But that’s where they lose the game.

Because by the time they get on the call—if the prospect even shows up—the sale is already lost.

Why?

Because the lead went cold.

No follow-up.

No engagement.

No relationship built.

Just a booking confirmation… and silence.

And when silence leads the conversation, here’s what you get:

No-shows

Ghosting

“I need to think about it…”

This is the difference between amateurs and elite closers.

Top performers never leave the pre-call phase to chance.

They build systems that warm the lead, prepare them mentally, and increase show-up and close rates—before the first word is even spoken.

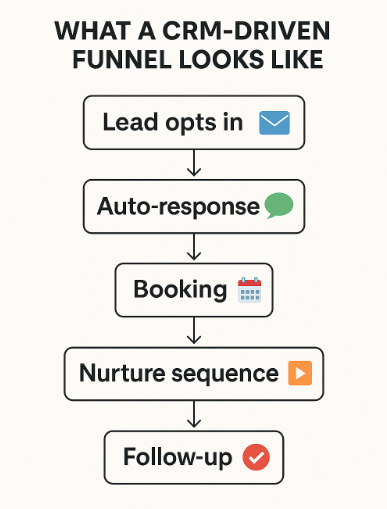

That’s the power of a CRM-driven sales system.

It’s not a tool. It’s your sales insurance policy.

Table of Contents

- What’s Really Costing You Sales? (Hint: It’s Not Your Pitch)

- CRM Automation: The Missing Link in Your High-Ticket Strategy

- Case Study Example: How CRM Tools Like HighLevel Boost Conversions

- Feature Deep-Dive: 3 Reasons CRM Automation Helps You Close More High-Ticket Deals

- Avoid These Costly CRM Mistakes

- Choosing the Right CRM for High-Ticket Sales

- Quick Setup: What to Automate First

- Sales Strategy Isn’t Just About Pitching — It’s About Systems

- Ready to Close More High-Ticket Deals — Without More Hustle?

What’s Really Costing You Sales? (Hint: It’s Not Your Pitch)

Your script isn’t the problem. Your objection handling isn’t the problem. Even your offer—if it’s good—isn’t the problem.

The real issue? Your system is broken.

Many businesses face similar challenges with their sales systems, struggling with high pricing, steep learning curves, or reliability issues that make it difficult to close deals efficiently.

Most entrepreneurs treat sales like a one-move game:

Generate lead Book call Close deal

But in today’s market, that’s not enough.

Buyers are smarter. Competition is fiercer. And if your sales funnel doesn’t address their pain points before the call… you’ve already lost them.

Here’s what elite closers understand:

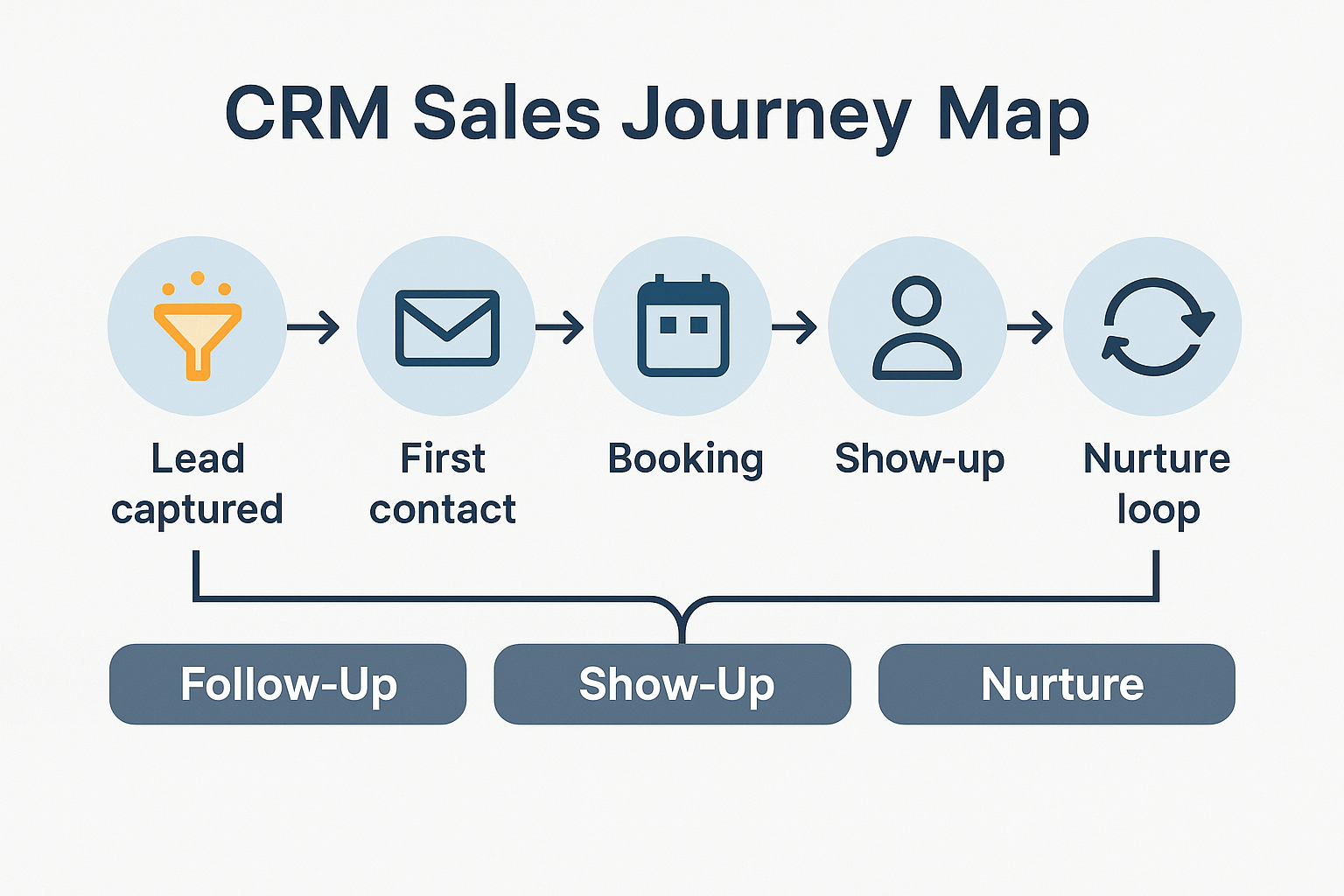

The buying process starts long before the pitch.

If your sales process isn’t warming the lead, building trust, and creating momentum… you’re leaving money on the table.

High-ticket deals aren’t closed through brute force. They’re closed through strategy, positioning, and process.

CRM Automation: The Missing Link in Your High-Ticket Strategy

Most sales teams treat CRM like a glorified contact database.

But the elite treat it like a sales weapon—one that automates follow-ups, personalizes messaging, and turns ice-cold leads into eager buyers.

If you’re relying on memory, spreadsheets, or scattered tools to manage your leads… you’re not running a sales system. You’re gambling.

A real CRM automation strategy allows you to:

- React to every prospect instantly (even while you sleep)

- Stay top-of-mind with the right message at the right time

- Nurture, engage, and convert without chasing

CRM automation streamlines the management of leads, follow-ups, and customer interactions, making it easier to organize and oversee every stage for greater efficiency.

And when you do that, here’s what happens:

Higher show-up rates Shorter sales cycles More deals closed—without burning out your sales team

This is the missing link for entrepreneurs stuck at six figures. Not another course. Not another hack. Just a smarter way to manage your buying process.

Case Study Example: How CRM Tools Like HighLevel Boost Conversions

Let’s be clear: This isn’t about promoting a specific CRM.

But if you want to close more high-ticket deals, you need to study what the best tools do—and how elite closers use them.

Take HighLevel CRM, for example.

It’s not just a CRM. HighLevel is a comprehensive solution that consolidates multiple sales and marketing tools—like lead management, communication, scheduling, and payment processing—into one platform. It’s a fully automated sales machine used by digital marketing agencies, sales teams, and consultants who don’t have time to manually chase leads.

Here’s how a system like HighLevel changes the game:

→ Automated Follow-Ups

Instead of sending one or two weak follow-ups, you can build a 7-touch sequence with:

- SMS

- Voicemail drops

- Facebook Messenger

These automated touchpoints help capture leads more effectively by engaging prospects at multiple stages and collecting their information for further nurturing.

And it all fires on autopilot.

→ Personalized Reminders

Prospects receive reminders before their call, along with:

- A landing page to confirm their appointment

- A video with success stories

- Pre-call FAQs to remove objections

An integrated inbound phone system can further improve customer engagement by centralizing communication and ensuring timely follow-ups.

The result? Higher show-up rates and prospects ready to buy.

→ Long-Term Nurture

If they don’t buy right away, no problem.

You can drop them into a 90-day nurture sequence filled with:

- Case studies

- Scarcity-driven offers

- Exclusive content inside membership areas

- Even full-on courses hosted inside the CRM

It also makes it easy to migrate your data from previous marketing tools, ensuring a seamless transition for ongoing nurture campaigns.

This isn’t theory. It’s the sales engine behind thousands of high-ticket funnels.

You don’t need to use HighLevel specifically. But if your CRM can’t do this—or worse, you’re not using one—you’re leaking money.

Feature Deep-Dive: 3 Reasons CRM Automation Helps You Close More High-Ticket Deals

When you rely on memory or manual effort, you drop leads. When you automate? You dominate.

Here are three reasons top closers use CRM automation to scale to seven and even eight figures:

These automation strategies are essential for optimizing sales performance and ensuring consistent, high-value results.

a. Automation Saves the Deal When Leads Go Cold

You already know most high-ticket prospects won’t buy after one message. In fact, 80% of sales happen after the 5th to 12th follow-up.

But here’s the reality: Most closers stop after two.

That’s why automated follow-ups are the difference between scaling and stalling.

Smart CRMs let you:

- Trigger responses within minutes

- Rotate messaging across email, SMS, voicemail drops, and Facebook Messenger

- Follow up relentlessly—without being annoying

Every touchpoint keeps your offer warm. Consistent follow-up is critical for closing deals, especially in high-ticket sales, as it ensures you stay top of mind and move prospects toward a decision. Every delay without automation? Cold lead.

b. Better Show-Up Rates = More Qualified Calls

No-shows kill momentum and waste time.

But automation lets you:

- Send personalized reminders via multiple channels

- Add urgency and value with pre-call content

- Let leads reschedule without ghosting

Systems like HighLevel even use a fully automated booking tool to manage appointments, confirmations, and changes—all without human error.

These automated reminders not only prepare leads but also enhance the customer experience by ensuring customers feel informed and valued, increasing the likelihood of a successful call.

And when leads show up prepared? You close more deals, faster.

c. “Not Now” Prospects Become Future Sales

Elite closers never hear “not now” and give up. They drop the lead into a nurture sequence and let the system do the rest.

This could include:

- Weekly content

- Scarcity-driven follow-ups

- Offers tied to deadlines

- Access to membership areas or mini-courses

- High-converting video content (thanks to unlimited video hosting)

Ongoing nurture sequences not only keep prospects engaged but also help strengthen customer relationships and increase their lifetime value.

With the right CRM, every “not now” becomes a “yes” in 30, 60, or 90 days.

Avoid These Costly CRM Mistakes

Most entrepreneurs don’t need more leads.

They need to stop wasting the ones they already have.

And guess what?

Even with a CRM, most still leave sales opportunities on the table because of how poorly they use the system.

Here are the most common—and most expensive—mistakes:

Mistake #1: Treating CRM as a Contact List

Your CRM isn’t just a glorified Rolodex.

If you’re not building sequences, tagging behavior, or tracking actions across the funnel…

you’re not managing leads—you’re babysitting them.

Mistake #2: No Follow-Up Logic

Following up once and hoping for the best? That’s not a strategy.

Elite closers use conditional logic and multi-touch campaigns tailored to potential clients’ behavior.

No logic = no leverage.

Mistake #3: Disconnected Tools and Manual Processes

Still managing your sales flow across 5 platforms?

That’s a full-time job.

The best closers use all-in-one platforms or integrated systems so nothing falls through the cracks. Managing all your sales and marketing activities within one platform increases efficiency and eliminates the hassle of switching between different systems.

It’s not about adding tools. It’s about streamlining your marketing efforts into one clear process.

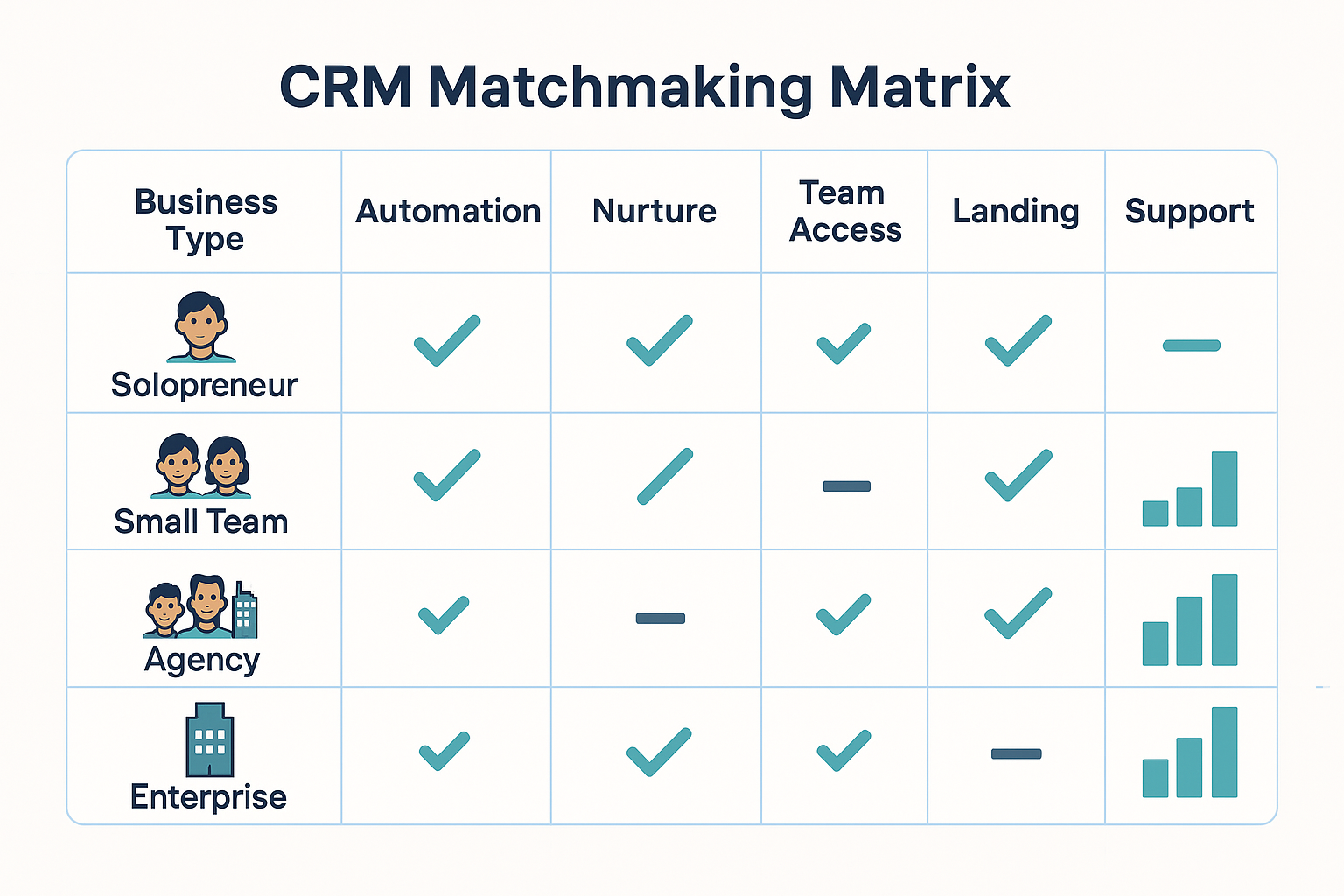

Choosing the Right CRM for High-Ticket Sales

There’s no “one-size-fits-all” CRM.

A tool that works for a 20-person agency may overwhelm a solo closer. And a startup solution might crumble under the weight of multiple teams, client accounts, and campaigns.

When selecting a CRM, be sure to compare pricing options to find the best fit for your business needs and budget.

So how do you choose the right system for your business?

Ask yourself:

What’s Your Sales Volume and Deal Size?

If you’re closing a few high-ticket deals per month, you don’t need the same system as a low-ticket eCom business. For high ticket products, it’s crucial to choose a CRM that supports the unique sales cycle and value-based positioning required to sell premium services.

Focus on personalization, nurture capability, and sales cycle tracking.

How Many People Will Use It?

Some tools charge based on seats, others offer unlimited users. Many CRMs also provide unlimited accounts, making it easier for growing teams and organizations to manage multiple clients or projects without restrictions.

If you’re building a sales team or scaling fast, make sure your CRM can support multiple stakeholders without adding chaos.

What Support Do You Actually Need?

Is there onboarding help? A dedicated support team? Or will you be left digging through help docs and forums?

For high-ticket closers, response time and reliability matter—especially when your income depends on it. Excellent service during onboarding and ongoing support is crucial for a smooth CRM implementation and long-term success.

Can It Replace Multiple Tools?

CRMs like HighLevel are designed for marketing agencies, but even solo coaches benefit from having:

- Booking pages

- Pipelines

- Follow-ups

- Landing pages, course areas, automations, and more—under one roof.

By integrating various marketing tools into a single CRM, you streamline operations, improve efficiency, and eliminate the need to juggle multiple platforms.

This isn’t about being flashy. It’s about removing friction for both you and your target audience.

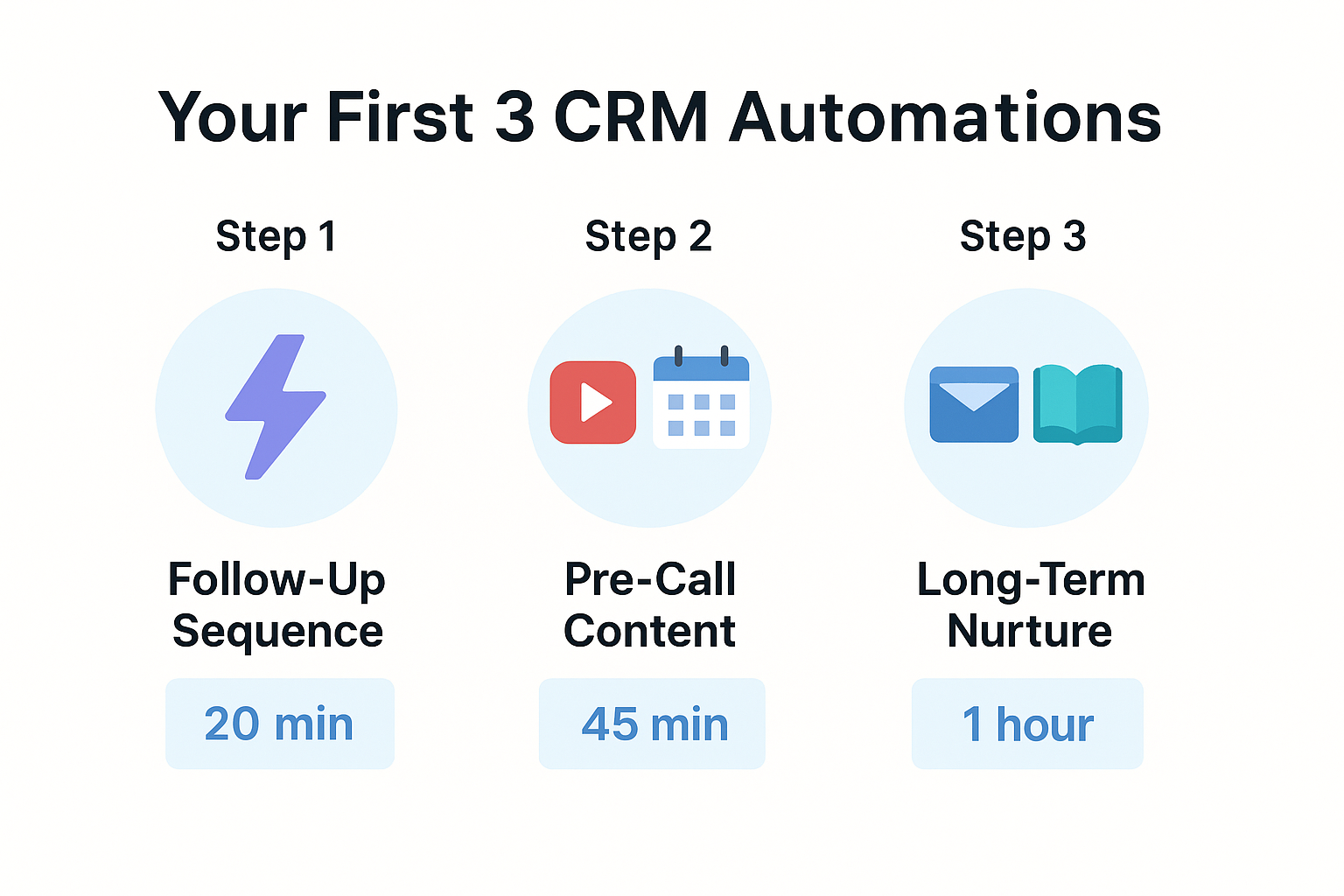

Quick Setup: What to Automate First

You don’t need a massive tech stack or a six-week build-out to start seeing results.

Modern CRMs come equipped with powerful tools that enable rapid automation and deliver immediate results.

In fact, you can automate the 3 most profitable parts of your funnel in just one afternoon.

Here’s where elite closers start:

The Role of Data Analytics in High-Ticket Sales

Creating a Sense of Community to Boost Conversions

1. Instant Follow-Ups

When a prospect books a call or downloads a lead magnet, you have minutes—not hours—to respond.

Set up a multi-touch follow-up sequence that includes:

- A quick SMS

- A personalized email

- A voicemail drop (if supported)

- Forced calls for immediate prospect engagement

- Optional: a short video hosted via your CRM’s unlimited video hosting

These first impressions build trust fast.

2. Pre-Call Nurture Content

Create a drip sequence that runs between booking and the call.

What to include?

- Client success stories

- A “what to expect” video

- A confirmation landing page built with your CRM’s page builder

- Reminders 24h, 3h, and 30m before the call

The goal is to warm the lead so they show up excited and informed, and to help build relationships with prospects before the sales conversation.

3. Long-Term Lead Capture + Education

For leads that say “not now,” use automation to:

- Deliver a 90-day email series

- Offer gated content (hosted in membership areas)

- Share expert tips or mini-courses (you can create courses right inside some CRMs)

- Track opens, clicks, and buying signals using built-in analytics tools

This turns indecisive browsers into high-value clients over time, helping both your business and your clients succeed in the long run.

Sales Strategy Isn’t Just About Pitching — It’s About Systems

Great closers don’t rely on personality.

They rely on process.

If you want to scale without chasing leads, your sales strategy needs more than scripts—it needs a system.

A smart CRM platform takes what already works and makes it scalable, predictable, and consistent.

Don’t just focus on the call.

Focus on everything that happens before and after.

That’s how high-value deals get done.

Ready to Close More High-Ticket Deals — Without More Hustle?

You don’t need more hours in the day. You need a smarter sales system that runs while you sleep.

Whether you’re a solo closer or managing a sales team, CRM automation helps you:

- Follow up faster

- Show up stronger

- Nurture longer

That’s how the best close more high-ticket deals—without working harder.

Want to see how this works inside real businesses?

Join us inside S.M.A.R.T. to get the full breakdown: How to automate, scale, and close deals consistently—without chasing leads.

Includes onboarding, support, and access to tools that match your target audience, pricing model, and strategy.

It’s time to systemize your success.