Are you wondering how many types of investors are there? Every day, there are people who fear losing money in an investment, while others never fear it. In any industry, investing has its own language. Many people are skeptical about where they invest their money because they don’t know how to build an ideal investment portfolio.

When it comes to investment. Most people may think of their homes or cars, for example. Rather, i’m talking about different types of investors. Which i’ll be sharing with you shortly.

Think of an investment portfolio as a safe to store your valuables. For example, real estate, stocks, bonds, mutual funds and so on. But an investment portfolio is more of a concept. Not a physical item.

If you know how to invest and build your investment portfolio, you won’t fear changes in the stock market. You’re wise enough to know that you don’t need to make more money to be able to save it because saving isn’t the answer.

Saving your money may help with future debts but it isn’t going to get you to financial freedom. What you need to do to build your wealth is to invest it, and the amount you invest has nothing to do with income level.

Rich people focus on investing. Poor people focus on saving. Share on X

Instead, what you invest is an indication of your financial confidence: your knowledge and skills when making decisions about money.

With that said, understanding what an investment portfolio is doesn’t tell you how to build one. First, you need to know the types of investors. And then you have to learn how to invest. Only then, you’ll be able to build your ideal portfolio.

Watch this video about how to get started.

Take Time to Learn The Types of Investors

It’s important for entrepreneurs to take the time to learn the types of investors. Why? Because they are unique players in the growth process of a business. To determine a company’s success or failure is ultimately determined by the level and quality of an investor’s involvement.

There are plenty of stories about people using their own savings to invest in a company. Many still deeply rely on investors. If you depend solely on your savings, you’re not likely to grow as big as you want it to be. Having an investor can play a big role in your success. As i said earlier, your growth process is determined by the level and quality of an investor’s involvement.

Now, let’s get into the 7 types of investors.

1. Banks

A bank loan works the same as any other business investment. The entrepreneur is required to present a business plan, and then the bank will decide whether they should provide the funds. Also, you may need to provide some proof of collateral or a revenue stream before your loan is approved.

According to Investopedia, if you want to fund the expansion of your small business. Consider a Small Business Administration (SBA) loan. However, if you have access to other financings with reasonable terms, then you are not eligible for this loan. This is a good loan to apply if you did not qualify for a traditional bank business loan.

2. Angel Investors

An angel investor is a high-net-worth individual who provides financial aid to help the business get off the ground. They are often found among entrepreneurs’ friends and family. Typically, angel investors provide financial aid in exchange for ownership equity in the company. And this is usually a one-time investment to assist and support a company through its difficult early stage.

Now, this type of investment is risky, because it doesn’t represent more than 10% in your investor’s portfolio. But since they focused on helping startups. Therefore, they are the opposite of venture capitalists.

3. Venture Capitalists

So, what is a venture capitalist (VC)? A venture capitalist is an equity investor. They focus more on companies that exhibit higher growth potential in exchange for an equity stake. VC investors could be funding a startup that wishes to expand but doesn’t have access to equity markets. And usually, they do not.

The difference between angel investors and venture capitalists is that. They are willing to take higher risks because they know they can earn a higher return on investments (ROI) if those companies gain success.

So, whether you’re seeking an investor or looking to be an investor. Understanding the types of investors is important in today’s world.

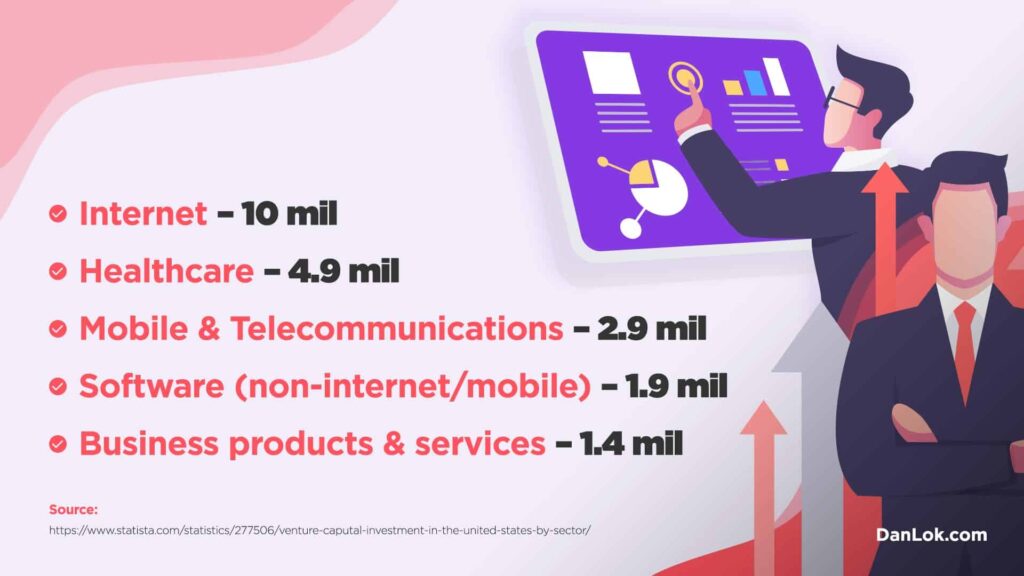

Here’s the top 5 value of venture capital investment in the 3rd quarter of 2019. (by industry)

4. Peer-To-Peer Lenders

Embracing technology in today’s digital landscape is a must. Peer-to-peer (P2P) lenders consider businesses and projects that are listed online. There are 2 websites that specialize in peer-to-peer lending. There are,

This type of investor acts similarly to the Small Business Administration (SBA) Loan. Now, when it comes to peer-to-peer lenders, your credit history plays a part when engaging a P2P lender. So, check and improve your credit history before finding a P2P lender. Because, if you have a low credit score, they may not find you loan-worthy.

On another note, make sure you understand the terms and conditions on your loan and make payments on time. Failure to do so will result in increased fees and most likely won’t get you another peer-to-peer loan.

5. Personal Investors

This may sound the easiest of all types of investors. But think twice before heading in this direction. It is always a risk when mixing business with family. Not only do you risk your finances, but also your family and friends if the business goes downhill.

When choosing this option, make sure your family ties are strong enough to withstand the pressure. You can either have each party sign a promissory note on repayment terms or sign a partnership agreement.

6. Corporate Investors

As a corporate investor, investing in startups carries a variety of benefits. This includes supporting their own growth and diversifying assets. While some invest outside of startups, more are leaning towards starting their own accelerators and incubators programs.

These types of investors can be great collaborators. However, a careful approach with a lot of patience must be taken into consideration. In order to have an enjoyable relationship between founding partners and corporate investors. It’s vital to understand each other and have some boundaries agreement.

7. Accelerators and Incubators

Accelerators and incubators are perhaps the ultimate gateways to a variety from the types of investors on this list. Why? Because, if you’re accepted into one of their programs. You may receive from $10,000 to $120,000 dollars to develop your idea for growth. The best part about this is, you’ll be able to benefit additional knowledge and resources.

However, there are certain things to consider when joining the program. So, if you’re looking to take your business to the next level. Be ready to hustle.

Building an Investment Portfolio

Markets go up and down. Investing isn’t a game and certainly, it’s not something that you could acquire in the shortest period of time. You can’t achieve perfect performance through market timing. However, you can build up your ideal portfolio. A solid portfolio certainly will allow you to succeed and avoid the stress within market volatility.

If you know how to invest, you know how to build your investment portfolio. Share on X

Your investment portfolio is like an umbrella for all of your accounts and they consist of some of these,

- A 401(k) or employer-sponsored plan.

- Cash in savings accounts or invested in certificates of deposit

- Individual retirement account

As i said in the beginning, your home and cars aren’t considered part of an investment portfolio. Rather, i’m talking about how you can use your money to make money. Such as,

- Stocks

- Bonds

- Mutual funds

- Real estate investment trust

- Alternative investments

- Private companies

So, if you understand how money works, that’ll help you build your ideal portfolio. And diversification is the key to success when investing. Also, when you understand the different types of investors. you’ll have clarity on investing principles. Here are 5 essential guides to building your ideal portfolio.

Have a Purpose and Stay Committed

Ask yourself this question before you invest. Why do you want to invest? Maybe it’s for your family or it could be generating an additional stream of income so that you can achieve financial confidence. Or maybe you want to buy a second home. Most likely, your answer could be all of the above. So, if you are aware of your purpose and you already know what you want to accomplish. What would it take you to get there? And out of these 7 types of investors, which would best fit you?

Solid Understanding of The Fundamentals

To build your ideal portfolio is not just investing blindly. Understanding the fundamentals of individual securities is crucial to building a solid portfolio. And that’s what they are assembled based on.

Your ideal portfolio should be diversified across sectors that are expected to perform well. Plan and have a good strategy to execute your purpose. Think quality over quantity. Share on X

Give Yourself Some Time to Build

This is critical because building your portfolio by identifying your purpose requires you to link all of your ideas. So, when you understand the types of investor that suits you best, you need to give yourself some time. Such as, what you need to achieve? So, based on your solid fundamentals, and a proven approach. It keeps you away from in-and-out, market-timing types of investing approach.

Focus on Things You Can Control

There are certain things you wish you could control. Such as, the market, companies that you’ve invested in and the political views. The truth is, you can’t. However, with your individual approach and mindset, focus on the things you can control. Determine a powerful strategy and stick with it.

Be Realistic With Your Goals

While most of us know how much we have saved. Very few have a realistic understanding of our goals. You might have an inkling of what you spend today and how much you need for the next stage of life. Maybe, you have a 5-year plan. But, how much risk are you willing to take on to achieve your goals? And does your 5-year plan look realistic with the steps you’re implementing?

What You Invest is an Indication of Your Financial Confidence

Your knowledge and skills when making decisions about money is critical. The way we save and make money can be grouped into seven types. I learned about these seven levels of investors from Robert Kiyosaki, and over the years, i’ve put my own spin on it.

While it’s common for one investor to drift a little from one type to another, most people stay fixed at one type for their entire lives.

[bctt tweet=”Saving your money may help with future debts but it isn’t going to get you financial freedom. You need to build your wealth to invest it, and the amount you invest has nothing to do with income level. ” username=”danlok”

As i said in the beginning, if you know how to invest and build your investment portfolio, you won’t fear changes in the stock market or unexpected bills. But most of us still have a certain fear when it involves money. Now, how to create that confidence to achieve financial independence? – to break-free from your fears.

The most important quality for an investor is temperament, not intellect. – Warren Buffett

Before i share the secrets of the rich with you. Which level of investor you are?

Level 0: Non-Existent Investor

At level zero, you have no investments or savings. You are oblivious of money matters in general or your spending habits in particular. You usually complain that you aren’t making enough money, or if you made just a little bit more money, everything would be okay.

The problem is your money management habits. Mike Tyson is an example of a non-existent investor. During his 20 year career, his income exceeded $400 million. Yet before his 39th birthday, he was $8 million in debt. Then $30 million, so he was $38 million in debt.

You might say, someone who makes millions a fight can’t be broke. But his financial statements say otherwise. He has the cash flow of a poor person. In fact, he’s worse than the poor. If your net worth is zero, you’re richer than him.

Level 1: The Borrower

If you’re a borrower, you’re often in far worse financial position than the non-existent investor, although your potential for change is greater. You usually make a bit more money than level 0. You have high debt because you spend all you make and more. Your idea of financial planning is to get a new Visa or Mastercard.

You live in complete financial denial and have often come to believe the situation is hopeless. When you are depressed, you buy more and get more debt.

Level 2: The Saver

As a saver, you usually set aside a small amount of money on a regular basis. The money is usually deposited into low-risk, low-returning vehicles such as a term deposit or money market account. You save to consume.

You save to go on a vacation, then save to buy a car, or save to buy a big TV. You are afraid of financial matters and won’t take risks. In fact, you’ll drive many hours to save a few dollars or line up on Boxing Day for 10 hours to save on one item.

Level 3a: Passive Investor

Passive investors are aware of the need to invest and top up their RSP or 401K by making employee contributions or outside investments like mutual funds, shares, stocks, or bonds. This level makes up two-thirds of the middle class. If you’re here, you’re financially illiterate. You don’t like to take risks.

You like to say things like, “I’m not very good with numbers,” or “I prefer to leave the money decisions to the professionals.” You’ll leave things in the hands of your financial planner but have little idea where things are invested or why. You also believe high rates of return like 20 percent are either illegal or impossible. You believe what you read in the news and do what others tell you to do.

Level 3b: Passive Investor Gambler

At this level, you don’t like to take risks but you also like to use sophisticated investment techniques such as margins, puts, and calls, without understanding what you’re really committing yourself to. Most of the time, you don’t discuss your losses with anyone, but always brag about your wins. You like to gamble.

I’ve seen entrepreneurs work very hard their entire lives to accumulate quite a bit of money. Then they take another person’s advice and in one year they lose what took them 10 years to make. It’s in the nature of entrepreneurs to work hard, so they’re smarter next time. But they’ve already lost decades of time because they took a gamble.

Level 4: Automatic Investor

Automatic investors are aware of the need to invest but they are also actively involved with their investments. If you’re at this level, you have a long term plan that will enable you to reach your financial objectives. You follow the plan of the wealth triangle: you have a high-income skill, build a scalable business, and have high-return investments.

You don’t use the fancy stuff that money managers use, like options or margin accounts. You buy good shares, proven managed funds or solid funds, and hold them for the long term. Warren Buffett is an automatic investor.

Level 5: Active Investor

If you’re an active investor, you manage your own money and don’t trust other people with it. You have a clearer awareness of investments and rates of return. You don’t necessarily take the advice you hear.

For example, i’ve worked in finance. I can say that 97 percent of mutual funds don’t work. Only 3 percent of the 5000 funds in Canada work, so i would not take the advice of financial advisors.

Active investors have to be clear on investing principles, which are the rules of investing. Your vehicles might be real estate or private companies. You actively participate in managing your investments and don’t just put aside your money and hope it grows.

You’re always looking, monitoring, and seeing how you can add value. You optimize performance and minimize risk, getting long term annual returns of 20 to 100 percent. You intimately understand money and how it works.

This type of investor has cash flow. You spend what you want after your assets crank out the cashflow for you. I am at this level.

Level 6: The Capitalist

Few reach this level and fewer manage to remain there. They are the Rockefellers, the Kennedys, the Fords, the Bill Gates, the Warren Buffets. They have two motivations for investing: they are good managers of their money while they are alive, and they leave a legacy to continue after they are gone.

Discover The Secrets of The Rich

No matter what your income level is, start investing. Have a financial plan for your future. Begin at the first level and work your way up. Remember, investing is about how much money you keep and what you do with it. So, do you want to learn the secrets of the rich? How do they invest, and build their ideal portfolio? How do they stay rich by investing?

To the select few of you… here’s your chance to learn from me in person. As i said in the beginning, many people are skeptical about where and how they should invest their money. And this is what i realized.

The secrets of the rich aren’t taught anywhere. So, I decided to show you how it’s done. And because you might have the same question as my followers and mentees. To answer these and many other questions, you’re invited to my event in Vegas i’m holding with my good friend. And the question is, “Dan, how do I grow my savings predictably and sustainably?”

The secrets of the rich aren’t taught anywhere. So, I decided to show you how it’s done. And because you might have the same question as my followers and mentees. To answer these and many other questions, you’re invited to my event in Vegas i’m holding with my good friend. And the question is, “Dan, how do I grow my savings predictably and sustainably?”

- Without losing to inflation.

- Without risking it all on the latest opportunities that could be gone with the wind.

- Or without keeping it in my low-return savings account?

If you want to discover the secrets of the rich. You must have the mindset to give more, do more and be more…

Learn the secrets of the rich. And change your life forever.